Just a reminder, main blog over on Pushing the Sky.

Steve Jobs and Adobe: A grudge of ages?

Steve Jobs is in the middle of the mother of all tech showdowns with Adobe over allowing Flash into the iPhone/iPad walled garden, even going to the effort of blocking a roundabout way of compiling Flash-assembled applications for the iPhone.

Yesterday he posted a reasoned argument pointing out why Flash won’t be allowed – critically, to attempt to position Apple as a reasonable party in this matter, Jobs emphasises Apple and Adobe’s past close relationship:

Apple has a long relationship with Adobe. In fact, we met Adobe’s founders when they were in their proverbial garage. Apple was their first big customer, adopting their Postscript language for our new Laserwriter printer. Apple invested in Adobe and owned around 20% of the company for many years. The two companies worked closely together to pioneer desktop publishing and there were many good times. Since that golden era, the companies have grown apart. Apple went through its near death experience, and Adobe was drawn to the corporate market with their Acrobat products.

This got me curious: the LaserWriter was launched in 1985, around the time Jobs left Apple. Apple then went through a near death experience before Jobs was brought back in 1997, and that was around the time Adobe went to the corporate (the unstated, insinuated “Windows” side) world to get some significant sales.

So what I want to know is: Is this a Jobs grudge playing out after 25 years? “Apple” might have worked closely with Adobe, but did Steve? Anyone got dates on this?

Mac OSX Snow Leopard cheaper in Australia?

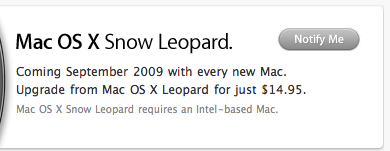

This morning I find that Snow Leopard, a.k.a. Mac OSX 10.6, will be released in September. It’ll cost US$29 to upgrade, which is way down on the usual US$129. I’m used to paying a significantly larger amount here in Australia for any Apple products though, so I thought I’d check what the price will be here on the Snow Leopard Australia page… and I get the following:

… so only AU$14.95 in Australia? Wow, how’s that work?

This here’s evidence for when they raise the price at a later date.

Update: Curiouser and curiouser – New Zealand page shows NZ$19, Canada page shows CA$29… Japan, India, UK, Germany, and France sites don’t mention upgrade prices, only that it comes with a new Mac (couldn’t help you with other languages). Perhaps price to be determined at a later date?

Update 2: And now there’s no price on pages outside the US. Hmmm.

Update 3: Final selling price was $39.95. Still would like to throw this at ’em to try to get some money back :)

The Multitasking Myth

The interwebbers are abuzz over an article titled “The Autumn of Multitaskers“, a wandering study and story of multitasking and its many and varied pitfalls, chief among which is the argument that multitasking is a productivity illusion. It allows you to look busy, but really you end up doing both things half-arsed. Bloggers of the world nod along in agreement, hailing it as a revelation while reading it on their iPhones, listening to the latest Arctic Monkeys on the commute in to work (while another tab loads up in the background).

The main point made in the article is that multitasking requires the brain to chop and change between tasks frequently, forcing it to move from a deep-involvement to shallow-involvement, and the penalty of multitasking is a drain on productivity, reportedly costing $650 billion a year in America in lost value

For the most part, I would agree with the point of the article, but there are two things that I would take to task about this.

The first is that this is somehow news. Breaking: doing many things at the same time means not everything is done perfectly! The author’s primary example is when he used a phone in his car, and nearly ended up killing himself. Can you say ‘duh’? Other examples are cited, though some, such as Enron’s ability to appear to be a successful trading company while really being a shonky outfit, is dubiously connected to multitasking.

The ‘revelation’ part of this article should be the part of the scientific study that suggests the hormonal shift of chemicals could be damaging in the longer run (it shouldn’t surprise that hormones shift), and the effect this particularly has on kids. Little column inches are dedicated to this, though to be fair it would make for dry reading.

The second is the excuse that the metaphor of brain-as-computer is somehow part of the cause of multitasking, as though computer multitasking has translated into expectations of human multitasking. This is part of the point that many are picking up on around the net, suggesting that somewhere we went overboard with the ability of computers to multitask, and that’s now harming us.

The reality is, as any credible 3rd year computer science student should be able to tell you, computers don’t multitask any better than we do. Until the recent popularisation of dual-core and multi-CPU machines, computers by and large had one CPU, one ‘brain’. Multitasking was an illusion provided by the operating system, where it did exactly what our brains do – puts down the current bit of work, picks up the next bit of work, and works on it, the loop repeating ad infinitum.

The metaphor of brain-as-CPU is a poor one because we can’t do the mathematical calculations as quickly. However, it is an appropriate one when it comes to multitasking, because computers do exactly the same thing. (One might suggest something about ‘in our own image’, if one was so inclined.) The argument that somehow we model our concept and use of our own brains through the metaphors of things we have made (with our brains), and thus computers are to blame for the multitasking world we find ourselves in is a fallacy, if simply because it is a tautology – we think our brains work as computers because we modelled computers on our brains.

Some in the blogging world have taken this as a revelation, and the enlightenment suggests why people maximise program windows (to see more? no, to focus more, obviously!), and the success of the full-screen writing apps recently. I would contend that you’re conflating one issue (multitasking vs single task focus) with other issues entirely (reduction of distraction temptations, more screen real estate). Computers have not foisted multitasking upon humanity, they have merely enabled it to run away from our limited abilities to keep up.

I do not argue that multitasking does not reduce competence, but I do argue with the attempt to blame it on our devices. We’re at fault, and our devices are enablers. We’ve worked out how to put multiple brains in computers to improve multitasking, but we’ve yet to get to that point in humans – until then, multitasking remains a high-investment low-return activity.

It’s not paranoia if you can prove it

Lies, damn lies, and cold hard evidence: The Australian Federal Police had a plan to keep Haneef locked up all along.

To quote:

The Australian Federal Police have admitted they had a secret “contingency” plan to keep then terrorist suspect Mohamed Haneef behind bars if he was bailed by a Brisbane magistrate.

The details of the plan came to light when details of emails, obtained by Mr Haneef’s lawyers under freedom of information laws, were published in The Australian today

Wow.

“The emails relate to normal operational contingency planning,” the spokeswoman [for the AFP] said.

Double Wow.

Leave aside all considerations of whether or not Haneef was guilty, or whether he was being used as a political football to kick dubious goals. The AFP have frankly admitted they had a ‘plan’ to keep a suspect in custody beyond that afforded to them by the standard democratic process. Wow. Only the brave would admit such a thing under free democratic process.

The evidence?

The first email, written by Brisbane-based counter-terrorism co-ordinator David Craig to commanders of the AFP’s counter-terrorism unit at 5.22pm on July 14, states: “Contingencies for containing Mr HANEEF and detaining him under the Migration Act, if it is the case he is granted bail on Monday, are in place as per arrangements today.”

Sounds pretty explicit. If they want to detain him under the Migration act, well, the way the Migration Act works means that they have to involve the Immigration ministry at some point in the chain. What does the Immigration department have to say?

After getting advice from Mr Andrews last night, [spokeswoman] Ms Walshe said the minister had “absolutely not” been involved in any “contingency” plan to thwart Ms Payne: “It’s not our email and it’s not something that we considered beforehand.

Really? Because, well, funny that, it sure as hell looks like it. The fact that he was detained right after he was granted bail sure looks like the contingency plan swinging into action.

This email was forwarded at 8.10am on Monday, July 16, by agent Luke Morrish, the AFP’s Canberra-based acting manager for domestic counter-terrorism, to top Immigration Department public servant Peter White.

Mr White, the department’s assistant secretary responsible for character assessment and war crimes screening, gave Mr Andrews comprehensive advice on his powers and his authority to cancel Dr Haneef’s visa and keep him in custody on the basis of secret evidence.

And it was the “character assessment”, funnily enough, that came to be the trigger for retaining Haneef. Hmm. From this, we can draw one of two conclusions:

- The minister knew and played along with the AFP’s contingency plan, abusing powers left right and centre.

- The minster didn’t know and was clearly incompetent.

As much as I favour the latter, I would be more inclined to believe the former.

A leading defence lawyer and close follower of the Haneef case, barrister Greg Barns, last night said the emails showed that “the AFP in conjunction with the Government were essentially completely undermining the judicial process.”

“They were ripping up the doctrine of the separation of powers,” Mr Barns said.

Clearly, there is some measure of abuse going on in the system here, and if Minister Andrews or Commissioner Keelty don’t fall on their swords as the slightest gesture to contrition, it’s not a system anyone can or should believe in.

The terrorists have a primary goal to restrict the freedoms of those in the west to act as they wish within a fair and equal legal framework. I wonder who is going to be the first to ring them to congratulate them that they’ve won. Long ago.

Apple Financial

Apple announced their financial results for the last quarter yesterday, and the numbers were good. And the market is pleased, send AAPL up and up and up, approaching $185 today.

Leave aside all the market cap nonsense that everyone is talking about, here’s a far more fundamental figure. If you’d bought Apple stock on Oct 31, 1997, and sat on it for ten years, you would have made a pretty penny or two. On 31/10/1997, Apple was $4.25 a share. Leaving the two stock splits since out of it, now, each share is worth $185. That’s a sweet little $180 per share you can book as profit.

But wait, there’s a time value to money too – what’s the cost of having it sit in Apple stock for so long when it could have been doing something else, like earning interest? Well, it’s take an average 4%, compounding yearly. That ought to flatten out the period in the middle when US interest rates were 1% ish. 4% over 10 years means you’ll pull out … $6.29. $6.34 if it’s continuous compounding! So you could book, uh, $178 as performance above average.

Put it another way – if it was yearly compounding, you’ve got 45% interest p.a., 38% if it’s continuous. Or a straight-up 3100% if it’s simple. Try getting that from your bank.

What about the competition? Microsoft? Hah. They’re up 81% total (opposed to Apple’s 3100% figure). Intel? 18%. (n.b. figures from Google Finance)

One might take the view that Apple’s current price is unsustainable, trading as they are at 50x Price-to-Earnings ratio, but if I’d had Apple shares in trust 10 years ago, and it expired right about now, I’d be more than happy to cash out =)

Election Week 1: The Tax Break

The Election certainly kicked off with a bang following the Coalition’s $34 billion dollar tax cut package (over 3 years). Labor held out to the end of the week before unveiling a similar package, for $31 billion, with the bulk of the additional $3 billion going towards education – as a tax rebate for families – and some $600 million promised to reduce waiting lists at hospitals, and finally pocketing some $200 million out of the remainder for the government surplus.

The Liberal move surprised me little – Howard and Costello have a track record of buying votes with tax breaks, and people have come to expect them rather than consider it an exceptional circumstance. The truth is however that these reductions in personal tax rely on some other part of the tax base holding up the fort, and while that is the companies at present, it’s a fragile thing on which to base a long term strategy, which eroding the income tax base certainly seems to be.

Still, it’s a bit of more-of-the-same from the Liberals, and I don’t think anyone was surprised too much by them. Polls on Wednesday suggested it resulted in a 2% swing back to the Liberals, bringing them to within 10 points for the first time in a long while.

Labor held out for a few days, rather than react and be forced to reveal their own policy in whatever state it happened to be in. However, when it was released it by and large mirrored the Coalition policy, up to the point of the richest tax bracket (i.e. completely irrelevant to the majority of voters).

This disappointed a lot of people, I’m sure – when you’ve got Jeff Kennet saying the tax cuts would be better spent on health, education and such like, you know perspectives have changed; now we’re just waiting for the politicians to catch up. The $2.3 billion for education and $600 million for hospitals that Labor skimmed off the Liberals’ policy got buried in the headline that the tax cuts will be largely mirrored.

It seems like both sides took to appealing very cynically to people, effectively saying your vote is linked to your hip pocket; it may be that this turns out to be true, and that is what Labor is betting on by trying to neutralise the issue in mirroring the cuts. What I think a lot of people wanted to see though was for Labor to be different – it might not win so many cynical votes, but by being different Labor could have stolen a march on the Coalition.

Spending on education and health are two things that the Liberals could not attack for being “wasteful” or any of the tag lines that would typically be rolled out in the face of different priorities. If $15 billion had been poured into universities and technical schools, virtually guaranteeing a reduction in HECS and fees, it would play very well to the families. Spending the next $15 billion on hospitals would have made a huge impact and really cemented Labor’s position as the social-services party – it might be an old cliché, but the Liberals would be committed to delivering some $30 per-week-over-three-years worth of tax cuts while Labor would be promising to fix services. That would be the true test of the cynical vote and establish a clear difference.

Instead, we’ve got a race to the bottom. The tax cuts are clearly inflationary, and the Reserve Bank is sure to take this view when considering the next round of interest rate movements.

If I were to draw the analogy to the financial world, this is a company promising to pay out a huge dividend. This pleases the simple investors – it means they get a cheque in the mail that’s money for holding the shares. More sophisticated investors however should take it as a warning – dividends are only paid out when the company has no idea what to do with the profits and cash it’s got sitting on its books. That means the company doesn’t have any useful projects it could invest the money into and potentially generate more money down the track.

Microsoft for years didn’t pay a dividend because it had projects to invest money into. In 2004, they had a lot of money on their books and nothing useful to do with it – so they paid it out. This was a clear indication Microsoft didn’t know where to go next, and these tax cuts are much the same concept, broadly – returning money to shareholders of Australia Inc. Except those shareholders are effectively customers too, and they aren’t necessarily happy with the service they’re getting.

All in all, tax cuts are a cynical way to win government, and indicate a lack of direction. They do have an immediate appeal, however, and we see this played out particularly in Australia where compulsory voting pushes the decision of choosing government to the marginals, where cynicism is far more likely to win for its immediate appeal, rather than any long term plan that might help. Here’s hoping this is one promise that can be reneged in favour of more appropriate spending.